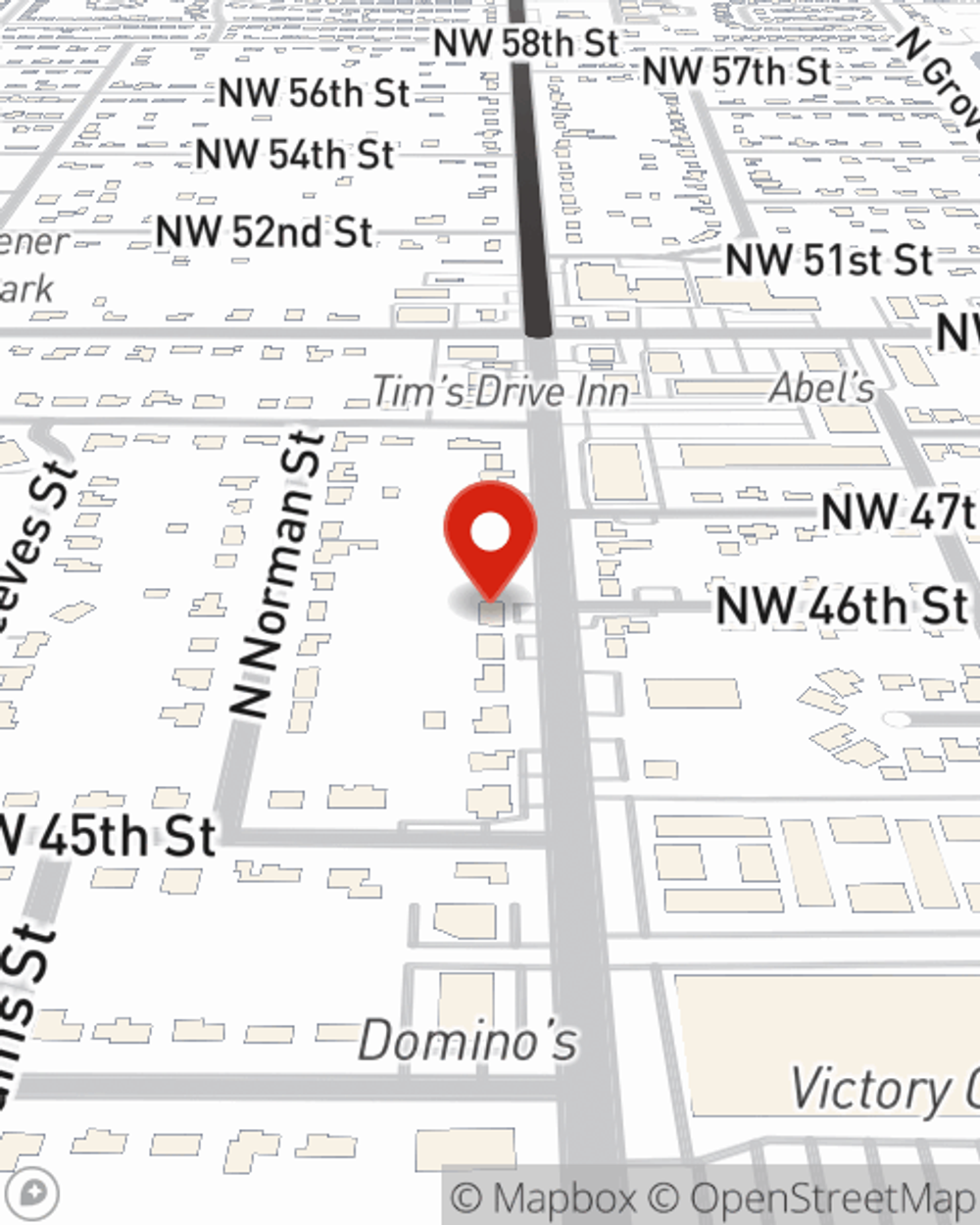

Business Insurance in and around Oklahoma City

One of the top small business insurance companies in Oklahoma City, and beyond.

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Gary Unruh can relate to the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to look into.

One of the top small business insurance companies in Oklahoma City, and beyond.

Insure your business, intentionally

Protect Your Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your salary, but also helps with regular payroll costs. You can also include liability, which is key coverage protecting you in the event of a claim or judgment against you by a customer.

At State Farm agent Gary Unruh's office, it's our business to help insure yours. Reach out to our terrific team to get started today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Gary Unruh

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.